By Shiv Mehta

The Chinese yuan (Renminbi) is the currency of China, with the currency code CNY and symbol ¥. In early 2014, the CNY was the seventh most traded currency in the world. According to SWIFT's report, it ranked fifth as the most traded currency at 2.2% of SWIFT payment behind JPY (2.7%),GBP (7.9%), EUR (28.3%) and USD (44.6%) by the end of 2014. In February 2015, RMB was the second largest currency to be used in trade financing, and was ranked ninth in foreign currency trading.

As per a report published by Deutsche Bank (DB), the internationalization of China’s Renminbi (RMB) has been described as the most significant global financial markets development since the formation of the euro. In recent years, China has demonstrated concentrated efforts to promote the use of RMB in cross-border trade, financing and foreign direct investment (FDI), especially in Hong Kong, Taiwan and Singapore.

The RMB internationalization accelerated in 2009 when China established the dim sum bond market and expanded the Cross-Border Trade RMB Settlement Pilot Project, facilitating pools of offshore RMB liquidity. The below chart shows increases in Cross-border RMB settlement in the period from Jan 2012 to Jan 2014.

U.S. Dollar Vs. Chinese Yuan

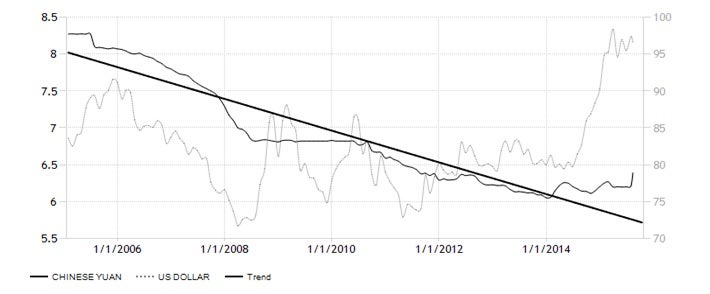

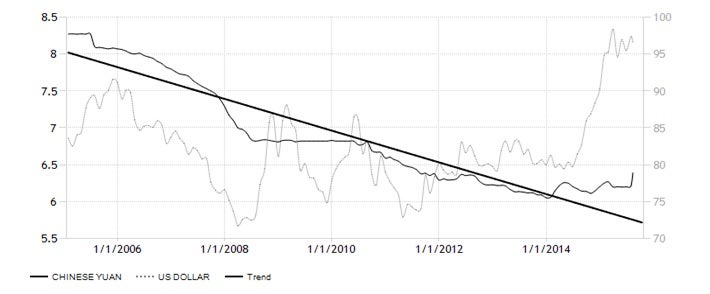

The most popular China Yuan Renminbi exchange rate is the USD:CNY. During the period from 1997 to 2005, the China used conventional dollar peg system, and the Chinese yuan was valued at approximately 8.3 CNY per U.S. dollar. In 2005, the Chinese government transitioned to a managed floating rate system and revalued the CNY to 8.1 per USD. Under this system, the yuan's value is determined by using basket of currencies, and it is believed that the highest weightage is given to U.S. Dollar. The below chart shows the correlation between the dollar and the yuan.

As part China's efforts to internationalize the yuan, the Chinese government put forth a pilot program to regulate country's international trade with countries such as Hong Kong, Macao and ASEAN countries in 2009. The plan was initiated in only 5 provinces of China: Shanghai, Guangzhou, Zhuhai, Dongghuan and Shenzen. Since then, the program has been expanded to other provinces and allowed trade with rest of the world. The Chinese government has taken more measures to promote the RMB as a reserve currency by signing agreements with Australia, Japan, Thailand, Russia, and Vietnam to allow for direct currency trade, instead of the erstwhile conversion to the U.S. dollar.

Recent Chinese Yuan Devaluation

The People's Bank of China (PBOC) devalued the yuan by nearly 2 percent on Aug. 11. The PBOC called it a free-market reform but some saw it as the start of a long-term yuan depreciation to spur exports. The USDCNY traded at 6.39 CNY on Friday August 14, according to interbank foreign exchange market quotes. The Chinese Yuan averaged 6.94 from 1981 until 2015, reaching an all-time high of 8.73 in January of 1994.

Economists and currency traders said it is an improvement over the previous system since opening rates are more explicitly linked to the prior day’s closing level. As per the International Monetary Fund (IMF), China’s currency is not undervalued despite this devaluation. However, China, the world’s second-largest economy, still needs to adopt a fully market-based exchange-rate system within three years. It is believed that this currency devaluation would support China’s dwindling exports and sluggish economy which grew by 7% in second quarter. China has set an annual target of about 7% growth while the IMF projects annual growth of 6.8%.

Goldman Sachs said the yuan devaluation “has been important for commodity markets and they believe it signals that global macro conditions have changed”. They also said China had joined a “negative feedback loop” that is pushing commodity prices down as growth slows and businesses and households, nervous about the future, reduce their borrowing and spending.

China Yuan and the Russian Ruble

Trade between Russia and China has grown by leaps and bounds as noted by the increase in bilateral trade from USD 15.8 billion in 2003 to USD 95.3 billion in 2014. According to forecasts, bilateral commerce could grow up to $100 billion in 2015 and if the two countries continue to nurture the right conditions for trade investment growth, it is likely to reach $200 billion by 2020.

The two countries are expected to reduce their dependence on the US dollar in bilateral trade in favor of their own currencies, calling attention to the importance of their economic relationship. Russia, which is facing financial restrictions by western countries on account of Ukraine crises and dwindled economy conditions due to decline in oil prices, is expected to increase its trade with China and that is also in CNY. This is evident by the fact that Moscow Exchange’s turnover in the Chinese Renminbi grew 700% in 2014. From 17 March the Moscow Exchange has started trading in a futures contract on the currency pair Chinese Renminbi – Russian Ruble.